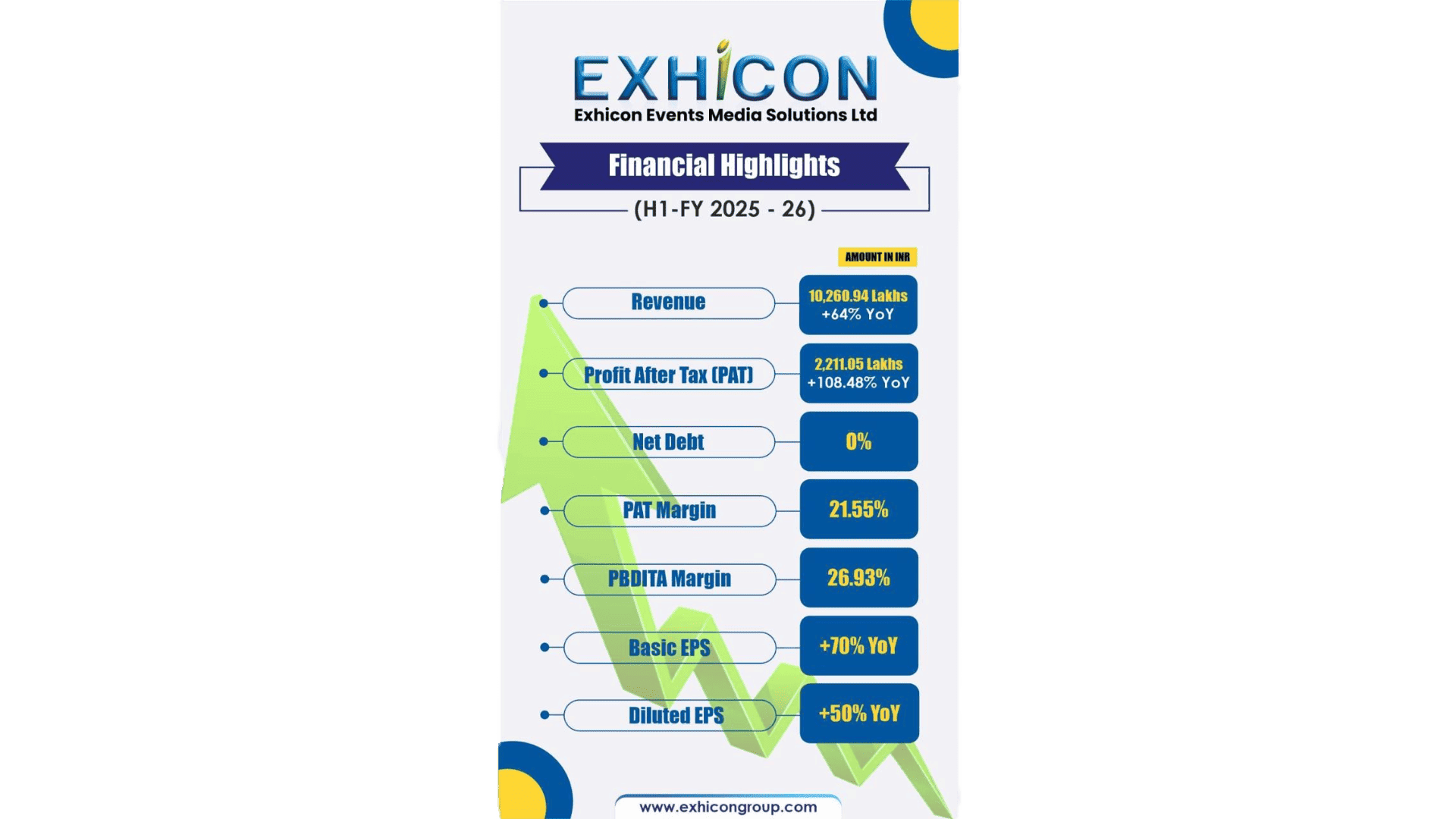

EXHICON’s LISTED ENTITY ANNOUNCES STRONG H1 FY2025–26 RESULTS

Revenue up 64% YoY | PAT more than doubled | Debt-Free Status Maintained | Strong Liquidity Growth

Mumbai, November 10, 2025:

Exhicon Events Media Solutions Limited (BSE: 543895), India’s leading fully integrated exhibitions, events, and media solutions company, announced its financial results for the half year ended September 30, 2025, reporting robust growth in revenue, profit, and shareholder value.

Key Financial Highlights

•Strong Revenue Growth: The company reported consolidated revenue of ₹10,260.94 lakhs, up 64% year-on-year

•PAT More Than Doubled: Profit After Tax rose by 108.48% YoY to ₹2,211.05 lakhs, with improved operating efficiency and cost management.

•Debt-Free and Liquid: The company maintained a debt-free status with a cash balance up 140% YoY, reflecting robust financial discipline and internal cash generation.

•Healthy Margins: PAT margin improved to 21.55%, while PBDITA margin stood at a healthy 26.93%.

•Strong Balance Sheet: Shareholders’ funds rose to ₹16,840.25 lakhs, with reserves and surplus increasing by 47% to ₹14,556.43 lakhs.

•Continued Expansion: Investments in property, plant, and equipment increased significantly to ₹6,101.06 lakhs, underscoring the company’s commitment to infrastructure development and capacity enhancement.

EPS growth -70 % rise on the basic EPS and 50 % Rise on the diluted EPS shows strong value for the shareholders despite dilution.

M Q Syed, Managing Director, Exhicon Events Media Solutions Limited, said:

“The first half of FY2025–26 has been an exceptionally strong period for Exhicon. We delivered profitable growth across all segments, maintained a debt-free position, and strengthened our asset base. Our focus on sustainable, integrated growth in the exhibitions and events ecosystem continues to yield results, and we remain confident of maintaining this momentum in the second half of the year.”

Outlook

With a robust balance sheet, growing project pipeline, and expanding event infrastructure presence, EXHICON is strategically positioned for sustained growth and shareholder value creation in the coming quarters.